There is a familiar saying around global debt. Everything is fine until one day it isn’t.

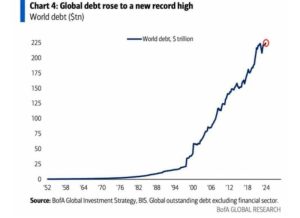

The consequences of continuing debt issuance are unavoidable. History has proven that debt destroys nations. But what does skyrocketing global debt mean to the global economy? Look at the change in trajectory from the late 1990s.

It is possible that the trajectory going forward looks similar. There is little doubt among experts that debt will continue, purchasing power will continue to erode, and it will work right up until it doesn’t work anymore.

The US, Europe, Japan, and China are all issuing massive amounts of debt, and currencies are eroding and will continue to erode in value as this continues. There is almost no way to stop this cycle unless you reset the entire system.

What will happen over the course of the next decade plus, as debt issuance goes up like an arrow from here?

Fiat is falling, and government spending will ultimately be the demise of the economies around the globe. It’s no wonder at all that real money, gold, is at the forefront of smart money and becoming the must-have asset.